Permanent ACA Subsidy Can Lead to Uninsurance Drop

By making the ACA subsidy permanent, uninsurance may drop by as much as 14%

April 16, 2021 – The American Rescue Plan Act (ARPA) includes several provisions meant to expand access to affordable health insurance in 2021 and 2022. One of these provisions is to increase the Affordable Care Act (ACA) marketplace subsidy. Increasing the ACA subsidy is meant to reduce household spending on health care.

According to a report from the Urban Institute, if Congress made Affordable Care Act subsidy increase permanent, uninsurance would drop. Making the ACA subsidy permanent can also lead to increases in marketplace enrollment and declines in non-group premiums

Changes in Number of Uninsured

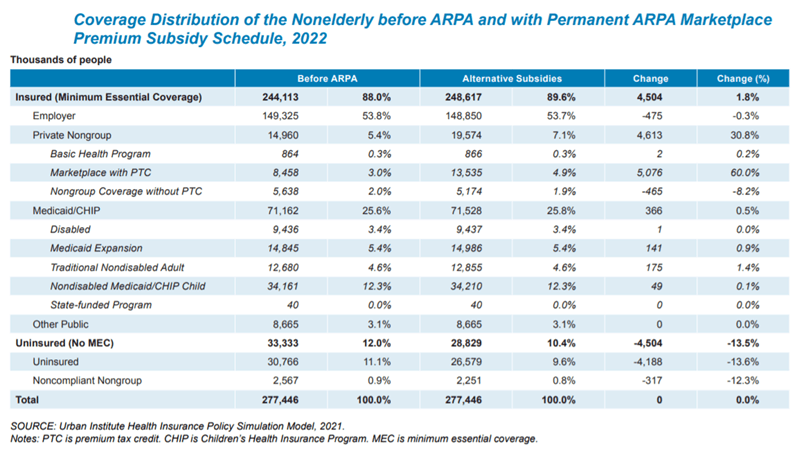

Using the Urban Institute’s Health Insurance Policy Simulation Model (HIPSM), researchers assessed the impacts of making the ACA subsidy increase permanent. As the chart below from Urban Institute shows, uninsurance can fall nearly 14% in 2022. This is equivalent to a 4.2 million beneficiary decrease.

In addition, about 317,000 people with plans that do not comply with ACA would switch to plans that did comply. This is because the ARPA makes premium tax credits available that would reduce premiums for marketplace plans. Attracted by lower premiums, marketplace enrollment is expected to increase 60% or by 5.1 million people in 2022.

Lower Premiums with Permanent ACA Subsidy

The study also notes that if the ARPA enhancements were made permanent, nongroup premiums would drop 15% lower. This is because the increase in marketplace enrollment would reduce the average health risk scores across the nongroup market.

The main reason behind reduced health risk scores is that individuals with increased healthcare needs are likely to have already purchased coverage before ARPA. The ACA subsidy is then more likely to attract uninsured individuals with lower health care needs. This includes younger enrollees.

ACA Subsidy Helps Those in Lowest Income Groups

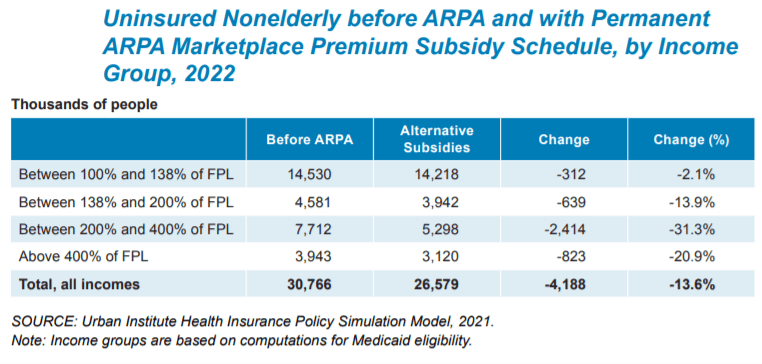

The Affordable Care Act subsidy would help those in the lowest income groups the most. The chart below from Urban Institute shows the number of uninsured individuals before and after the subsidies by income group.

Uninsured people with incomes under 400% of the federal poverty level (FPL) would greatly benefit from the permanent ACA subsidy. Under the ARPA, people with incomes above 400% of the FPL that meet other eligibility criteria, would be newly eligible for marketplace subsidies for the first time since the 2014 inception. As a result, the number of uninsured people would drop by 823,000, or just shy of 21%.

However, those in the 200% to 400% FPL bracket would see the largest decline. As the chart above shows, this income group will see 31.3% lower uninsurance rates. Overall, with ACA subsidies extended beyond 2022, this group would see 2.4 million fewer uninsured individuals.

Those in the 128% to 200% of FPL and between 100% and 138% of the FPL would also see declines in uninsured individuals. Together, the groups would account for an additional decline of almost 1 million uninsured individuals.

To see the entire report from Urban Institute, click here.

The VBP Blog is a comprehensive resource for all things related to value-based payments. Up-to-date news, informative webinars, and relevant blogs in the VBP sphere to help your organization find success.

More Trending Topics:

Get even more VBP insights on LinkedIn & Twitter

The VBP Blog is a comprehensive resource for all things related to value-based payments. Up-to-date news, informative webinars, and relevant blogs in the VBP sphere to help your organization find success.